Growing Importance of Alternative Investments and Diversification Across Non-Traditional Asset Classes

November 13, 2023

Growing Importance of Alternative Investments and Diversification Across Non-Traditional Asset Classes

As traditional asset classes face challenges such as low interest rates and increased market volatility, investors are recognizing the growing importance of alternative investments and diversification across non-traditional asset classes.

Private Equity and Venture Capital: Private equity and venture capital investments are gaining prominence as investors seek higher returns and access to innovative companies These investments offer opportunities to participate in the growth potential of privately held firms and startups.

-

Real assets : Real estate, infrastructure, and natural resources are becoming increasingly attractive for asset allocation. These tangible assets provide diversification benefits, potential inflation hedging, and stable income streams making them appealing in uncertain market conditions.

-

Hedge funds and other alternative investment strategies are gaining attention as investors seek uncorrelated returns and downside protection. These strategies employ sophisticated techniques to generate alpha and manage risks.

Diversification across non-traditional asset classes can enhance portfolio resilience, reduce correlation to traditional markets, and potentially improve risk-adjusted returns. However, it is important to conduct thorough due diligence and understand the unique risks associated with alternative investments.

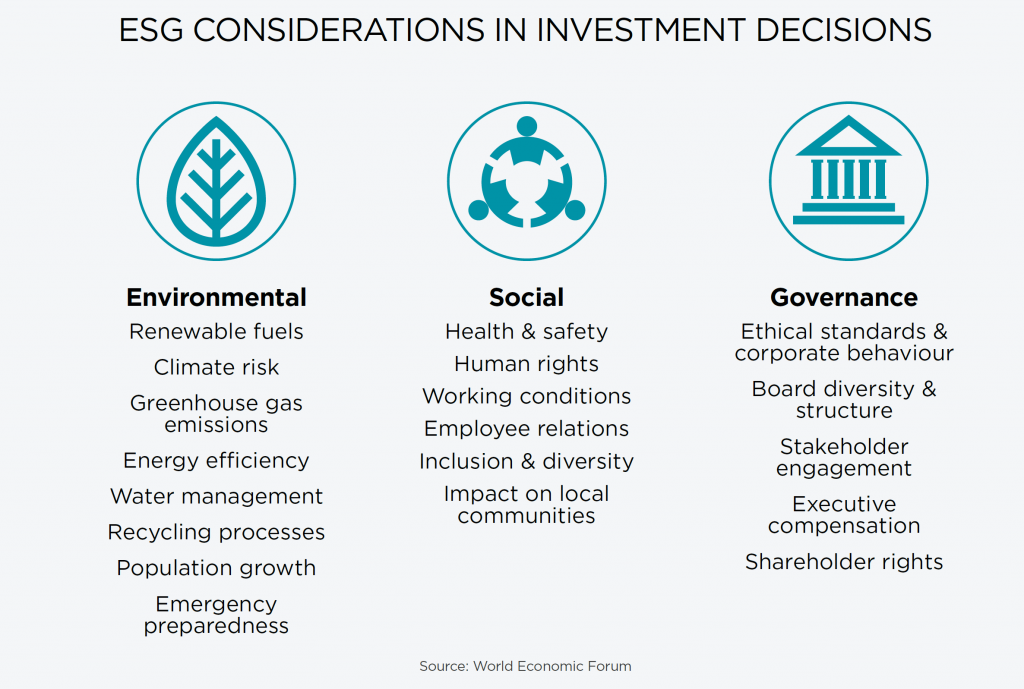

By embracing sustainable and ESG considerations, monitoring geopolitical events and regulatory changes, and diversifying across non-traditional asset classes, asset allocators can navigate the evolving investment landscape and optimize their portfolios for long-term success. These trends reflect a broader shift towards responsible and diversified investing practices, ensuring a more holistic and adaptive approach to asset allocation in the future.